Behind the bills: Sherwood advances tax credit for demolishing or revamping abandoned buildings

The rural representative wants to establish a financial incentive for revitalizing nuisance areas. Unlike a similar bill filed last year, House Bill 82 sets limits based on population size.

Albany County Rep. Trey Sherwood (HD-14) is running a bill this session that would make it easier for local communities to clean up abandoned or potentially dangerous “nuisance” properties.

House Bill 82 sets up a tax credit for property owners who shape up an ugly property. With prior city or town approval, the owner could be reimbursed for up to half the price of demolition or up to the full price of renovation.

“I love creating legislation that provides an incentive,” Sherwood said. “That’s like a warm fuzzy. That’s my jam.”

For a property to qualify, its local municipality would have to first confirm that it is indeed abandoned or otherwise a nuisance:

The governing body of a city or town may designate a property within the limits of the city or town as abandoned or as a nuisance for the purposes of this section if the property has been vacant for not less than six (6) months or if the property has been neglected and contains a significantly deteriorated or deteriorating structure as determined by the governing body … In determining whether a property is abandoned … a city or town shall examine the property and determine whether the property is occupied by the property owner or by permission of the property owner. In determining whether a property is a nuisance … a city or town shall consider whether an unreasonable or unlawful use or condition of the property has resulted or may result in injury to a neighboring property owner or endangers the life, health or safety of the community.

Official designation in hand, the property owner would then qualify for the tax credits, so long as they take action in a reasonable window of time. That action — be it demolition or renovation — requires prior approval from the city or town.

“Only approved expenditures shall be eligible for a tax credit,” the bill states. “The governing body shall not approve any expenditures that do not directly benefit the designated property.”

Sherwood serves as executive director for the Laramie Main Street Alliance, which promotes revitalization and economic development in its aim to foster a “vibrant downtown.”

In 2022, the alliance’s work led to Laramie being named one of the top main streets in America.

Sherwood’s own efforts to revitalize Laramie’s Wyo Theater taught her about the difficulties of turning around a dilapidated property.

“As somebody who is very passionate about seeing our downtown thrive and be home to new and expanding businesses, I saw — not only in downtown Laramie, but in downtowns all over the state — these instances where there were amazing buildings sitting empty, and businesses looking for a place to launch from,” Sherwood said. “It’s like, ‘Wait a minute, we have space, we have businesses, what is the disconnect?’”

That disconnect could be simply an underutilized space or disengaged property owner, Sherwood said. But it could also be that the property owner simply doesn’t know how to move forward or doesn’t have much incentive to find a new business in need of a space.

“This bill is meant to take away the barrier in that matchmaking equation,” Sherwood said.

This is not the first time such a bill has been tried, nor even the first time Sherwood has brought it. Drawing on earlier attempts from Albany County Sen. Dan Furphy (SD-10), Sherwood introduced a similar bill last year. It died alongside dozens of other bills when the House of Representatives failed to consider them before a key deadline.

House Bill 82 is not directly related to the state budget, so it will face an uphill battle in the upcoming budget session. Sherwood’s bill will need a two-thirds vote to survive its first major hurdle, introduction. But the representative is hopeful.

“The great thing about running a bill that failed is that there’s time to improve it,” Sherwood said. “And so I was able to have deeper conversations with some realtors, some property owners, some members of the Wyoming Association of Municipalities.”

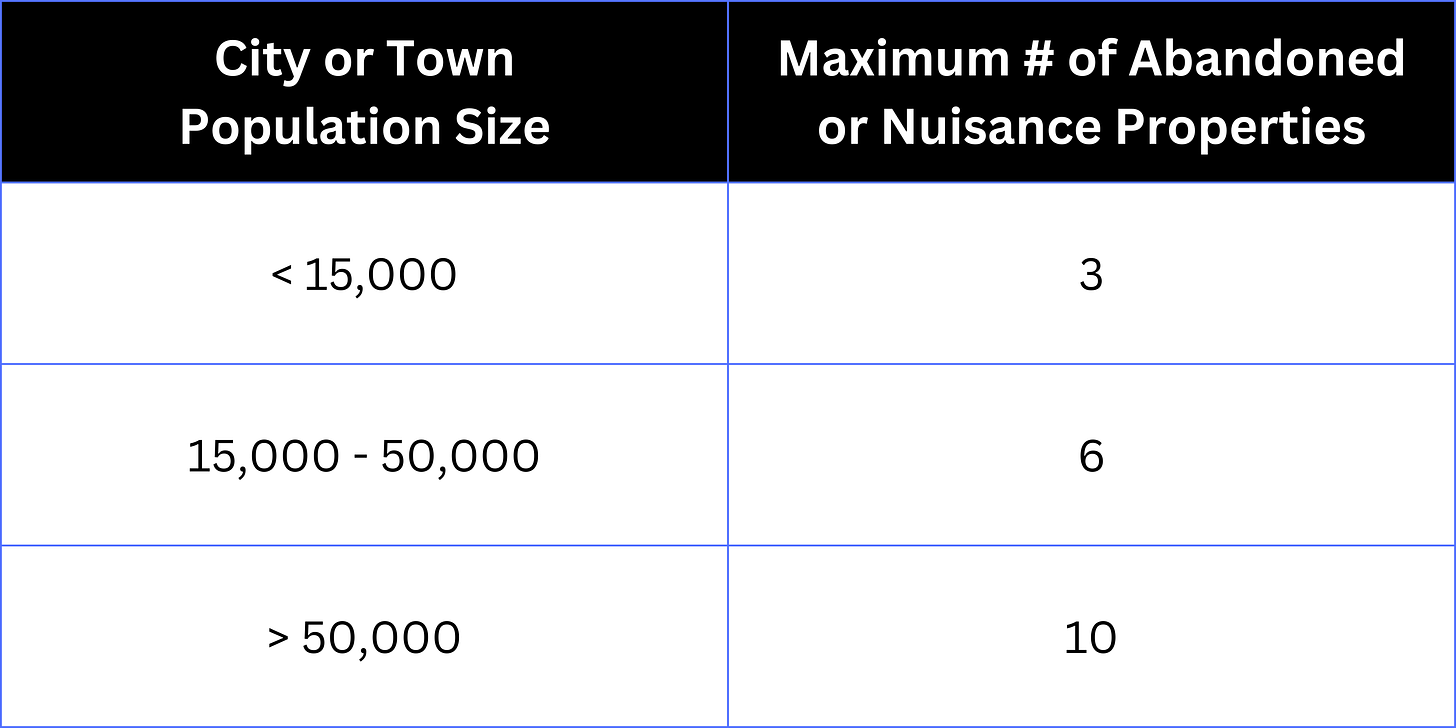

From those conversations, she learned that county commissioners in Wyoming wanted to see a limit on the number of buildings that could be declared abandoned at any one time. That provision is in the new bill, with firm limits based on population size.

“So there are some nuances to the bill that I would consider improvements that came from the people who are going to be impacted by it if it becomes legislation,” Sherwood said.

The 2024 Budget Session of the Wyoming Legislature starts Feb. 12. Sherwood’s bill will have to pass introduction by Feb. 16 to remain in play.

The purpose of this bill is to give taxpayer money to a particular organization in Laramie: A group called "Laramie Main Street." This group claims to be a 501(c)(3) charity but in fact is a self-interested corporation. It is not transparent (it operates behind closed doors and doesn't invite the public to its meetings) and lobbies the City to influence policy - illegal for a 501(c)(3) but it does it anyway. It doesn't accept input from the downtown community and often acts against its best interests, yet wants to be funded by taxpayer money, which it intends to use to enrich itself as a for-profit landlord (again, not legal for a 501(c)(3), which isn't allowed to conduct businesses normally engaged in for profit). We should think long and hard before giving gifts to such organizations out of the public till.