City supplemental budget tackles housing, employee compensation and roads

Wind taxes are shielding Laramie from the effects of property tax relief. City staff highlighted that the “cost of government” in Laramie is among the lowest in the state.

The Laramie City Council could commit another $14 million to road improvements, set aside $5 million for housing infrastructure, and give classified city staff a 3% cost-of-living pay bump.

These are the major adjustments City Manager Janine Jordan has recommended in the supplemental budget she presented to the council across five total work sessions.

Jordan told councilors the city’s budget encompasses everything people care about when it comes to their municipal government — from policing and parks to road improvements and economic development.

“It is really the common thread that links all of the administrative business units of this city and our governance objectives,” she said. “It’s the one sort of clearinghouse place where you can really see: here’s what the city is up to; here’s where their priorities are; here’s where they put their money.”

The city’s goal is twofold, Jordan said:

Provide essential city services, from water to mosquito control to emergency response;

Go beyond those essential services to pursue the loftier goals established by the council, such as environmental sustainability or economic development

Doing the latter requires achieving the former as efficiently as possible.

“When you think about the policy goals that you establish each year, those are oftentimes in excess of the basic services and goods that we are obliged to provide as a municipality,” Jordan said. “We will maximize the budget in order to try to provide our basic goods and services at the least possible cost to free up resources to fund the policy objectives of the city council.”

The city prepares a two-year, or “biennium,” budget every other year. In the off years, such as 2025, the city council approves a supplemental budget, making adjustments for new programs and for unforeseen or immediate cost increases.

Across more than 10 hours of budget work sessions, city staff and councilors dug into each city division and fund, outlining proposed adjustments.

The councilors then offered a few amendments during yet another work session last week. The council must take a final vote on the supplemental budget before July.

In addition to the recommended supplemental budget — a 315-page public document available here — the city has also produced a new document called the “Budget in Brief.”

This 22-page overview provides a high-level summary of where the city gets and spends its money. But Administrative Services Director Jenn Wade warned that the overview does not give the whole picture.

“The [much longer] budget book is prepared for you as policymakers and for the community, and is meant to tell you the entire story,” Wade told the councilors. “It is not meant to be a summary, and there’s a good reason it’s not supposed to be a summary, but we realize that it may be a lot of information, because there’s a lot of information necessary to understand what's going on in our community.”

The Budget in Brief is an attempt to bridge the communication gap and to provide the public something it can sink its teeth into.

It’s not the only effort the city has made this year to make the budget more accessible. With the blessing of the council, city staff ran a social media campaign, with memes and videos, extolling the virtues of taking part in the city’s budget discussions.

Those discussions are open to the public but are never well attended. This year was no exception.

Cost of government

City officials stressed that Laramigos get a good return on investment with their local government.

Measuring what residents get from the city against what they pay, the State Department of Audit’s annual Cost of Government Report found the city of Laramie is one of the most efficient municipalities in Wyoming.

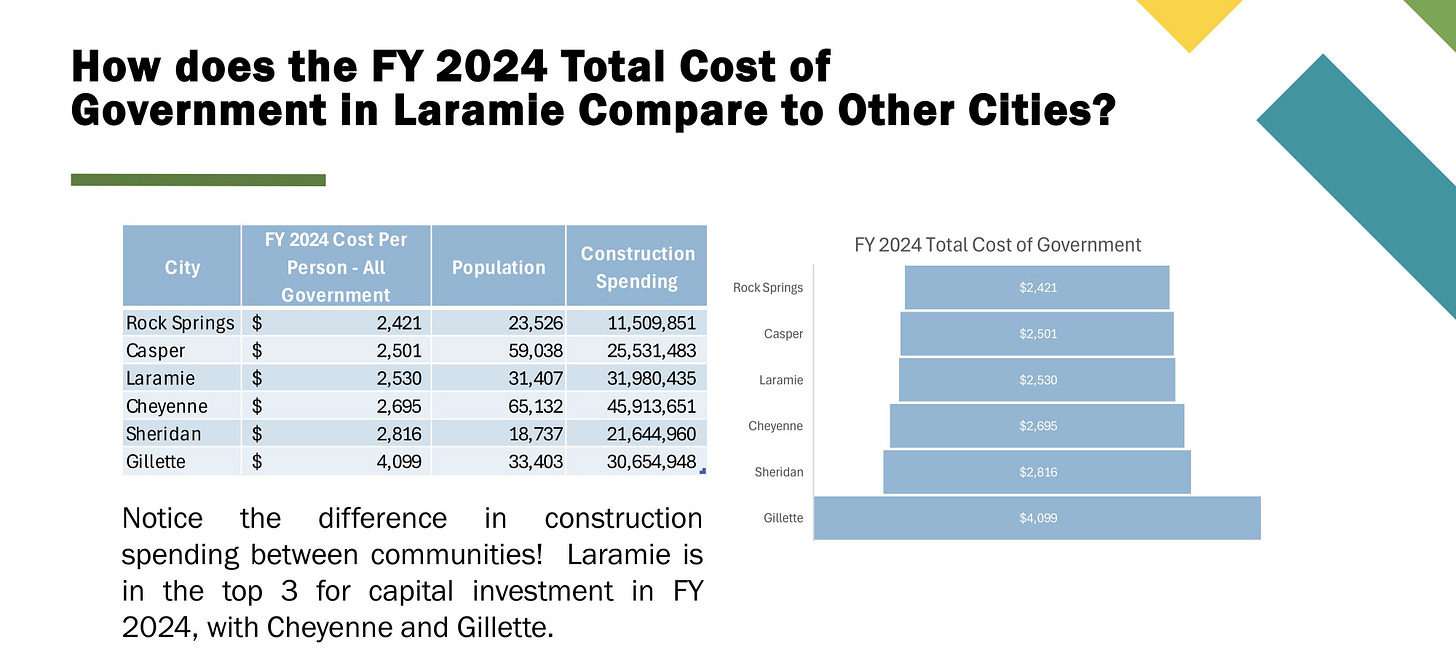

In fiscal year 2024, the cost of all government services was $2,530 per person in Laramie.

Government services in Casper ($2,501) and Rock Springs ($2,421) are more affordable by this measure, but Laramie stands above Cheyenne, Sheridan and Gillette.

However, these figures don’t tell the full story, city officials stressed. “Government services” means more in Laramie than it does in some other locales. In Laramie, for example, that dollar amount also covers maintaining a rec center and EMS service, which many cities don’t cover.

“Laramie and Casper are really the only two cities here that I think are ‘full service’ cities, meaning we provide the full array of government services,” Wade told the council. “So another way to look at this is we are neck and neck with Casper in providing the most services for some of the lowest cost of total government in the state of Wyoming.”

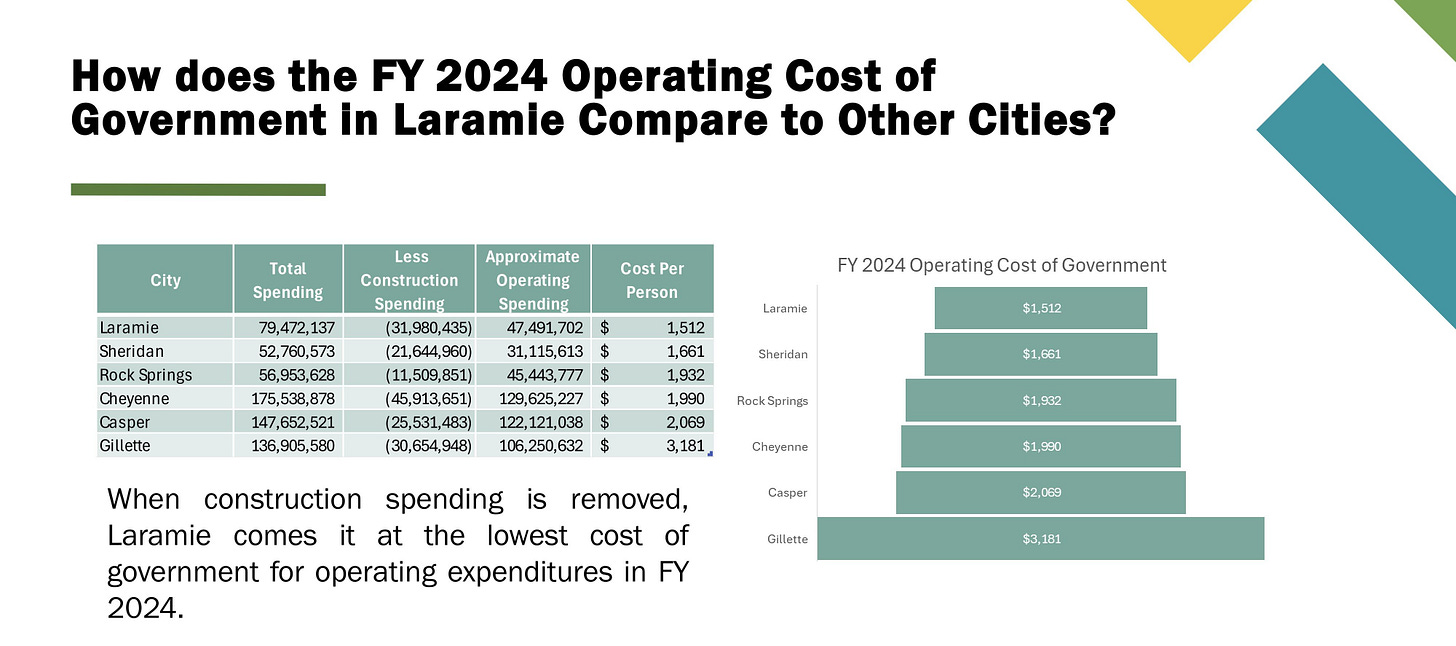

Laramie’s advantage gets even stronger if one removes construction costs — which the Gem City has a lot of right now — and considers only operating expenses. According to the city’s April 8 presentation, Laramie has the cheapest operating costs in the state at $1,512 per resident.

Wade said Laramie has had to do more with less, and it’s been smart about budgeting.

“We should always look for ways to incrementally improve what you’re doing so that the citizens can receive better value for the services you provide,” she said. “But Laramie, historically, has been pretty constrained in its level of resources, and we’ve gotten used to being small and nimble and lean.”

The budget for fiscal years 2025-2026 remains largely intact

Last year, the city approved a nearly $200 million biennium budget for fiscal years 2025 and 2026.

With their unanimous 6-0 June vote, the councilors ushered in a two-year plan to pave city streets with taxes collected from wind farms and ween the Laramie Rec Center off of its pandemic-era subsidy from the general fund.

The supplemental budget doesn’t make many significant changes to the division of the biennium budget’s allocations, but it does introduce some new investments and expenditures.

$5 million for housing

One notable adjustment included in this year’s supplemental budget is the addition of $5 million to fund infrastructure buildout to support housing development.

“This program will allow for cost sharing with housing developers constructing water, wastewater or street infrastructure necessary to serve newly developed neighborhoods,” Jordan writes in this year’s budget narrative. “The program will prioritize build-ready construction projects with demonstrated financial capacity that will bring new housing units into the market at an attainable price.”

The $5 million comes from unallocated reserves, including $2 million from sales and use taxes collected from wind energy development and $3 million from water and wastewater fund investment earnings.

$14 million for roads

The supplemental budget also dedicates $14 million “to improve pavement conditions and address a backlog of maintenance” for city streets. Jordan’s budget narrative states:

The current Pavement Condition Index (PCI) rating is 58/100 indicating streets are in “fair” condition, on average. The City must invest at least $6.2 million per year to prevent further deterioration. To improve the average rating will require an annual investment of $11.4 million or more. With $6 million already appropriated for street repair in the general fund, this action would amount to a total infusion of $20 million into the street maintenance program over the next 2-3 construction season cycles.

The money comes from unallocated reserves, which the city has built up in recent years to take on improvement projects of this nature.

One source of new revenue has been the sales and use taxes collected from wind development projects. This new revenue has been a windfall, so to speak, and a welcome one — but it’s also unreliable and city officials don’t want to count on it continuing into the future.

The solution is to keep these temporary additional revenues in reserves and use them for capital improvement projects.

“They should be for one-time expenditures for capital investment,” Wade told the councilors. “Governments do build reserves over time. We certainly have reserves built in the general fund right now due to those one time collections from wind energy in the area. And so we believe very strongly that that money should be used for one-time expenses, primarily in capital investment, because it’s not expected to be ongoing.”

Raising staff salaries 3%

The city employs more than 200 people.

Measured as full-time equivalents (FTEs) and according to the supplemental budget book, that includes 76 FTEs in the Laramie Police Department, 47 FTEs under the Laramie Fire Department, 27 FTEs through public works, and 19 FTEs through the Parks and Recreation department.

As of a few years ago, the salaries offered by the city of Laramie were not competitive. That meant prospective employees could work elsewhere for better pay. So the city implemented a market-based salary bump during fiscal year 2024 that gave most employees an average raise of around 9%.

But the price of nearly everything has gotten more expensive since then, prompting Jordan to recommend a 3% cost-of-living increase for non-unionized classified staff in this year’s supplemental budget book.

“This cost-of-living adjustment will maintain the city’s competitive pay structure considering inflation that has occurred in the intervening 12-month period,” Jordan writes.

Wind, cigs and property taxes: Monitoring the general fund

The city’s budget is divided into funds — discrete pools of money fed by certain revenue sources and used for specific ends.

Some of these are the enterprise funds — water, wastewater and solid waste — which are supported by user fees and employed by the city to provide the services their names imply.

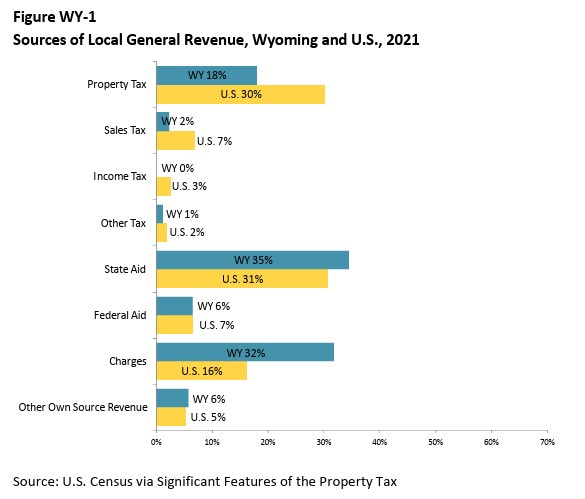

But the largest fund, known as the general fund, is more complex. It’s supported by taxes, payments from the state, grants awarded to the city, fines imposed on residents and other sources. But the majority of its revenue comes from taxes.

The general fund pays for fire, police, public works, parks and recreation and other city services.

A decade ago, the general fund was spending more than it was taking in.

“What we see is expenditures were more than revenues from 2014 to 2017,” Wade told the council. “When we did a series of sustainability adjustments, which means reductions in services, from 2017 to 2018 or 2019, you see those lines just about equal — really limiting growth. And then you see those lines start to flip.”

Since then, revenue has outstripped expenses, allowing the city to build up reserves.

“That has not been a normal situation for Laramie,” Wade said. “And considering the needs of our street infrastructure, [that’s] something that, in my opinion, is most welcome.”

As previously noted, a lot of that increased revenue — and therefore a lot of the city’s new outsized reserve — has come from wind development. Wade said residents might be alarmed to see the city taking in so much more than its spending and holding onto that excess.

But this bump comes from the construction of turbines rather than the running of wind farms, and Wade said it can’t be relied upon as a new regular revenue stream.

“I know it’s causing some public questions, and it should be, but most of this is coming from wind energy development,” she said. “The Department of Revenue has repeatedly told us that we should not be relying on this revenue based on the information that they have, and we are trusting that.”

The windfall from renewables is especially welcome at this moment, as other developments threaten the city’s financial outlook.

Even though Wyoming residents tend to pay far less in property taxes than other Americans, the topic has gotten a lot of attention from state lawmakers, who advanced several bills and set up a future ballot measure aimed at providing property tax relief to homeowners.

That tax cut, however, could radically impact the government services that rely on property taxes — including services offered by the city of Laramie.

The infusion of wind tax revenues has offset some of the pain Laramie would have otherwise felt.

“Albany County continues to be very lucky because of the results of wind energy development,” Wade said. “It is my understanding, based on conversations with the county, that the initially estimated reduction of $800,000 to $1 million has been offset to net of $350,000 because of wind energy development in the area and the increase of other assessed property.”

Wind isn’t the only recent development bumping up the city’s revenue.

Like wind taxes, the city has backed away from its reliance on direct distribution from the state. In general, this revenue source has been trending downward. But in 2024, lawmakers approved a one-time bump that infused about $6 million into Laramie’s budget.

That’s a welcome addition to Laramie’s finances, but the city can’t count on it happening again.

“We’re sitting at about $4.9 [million per year],” Wade said. “It’ll sit there, we think, for this biennium, and then it’s likely going to drop down again to what we consider to be our maybe new normal amount of around $3.5 or $3.6 million per year.”

Other smaller revenue sources, like cigarette taxes and lottery distributions, are also going up because, Wade said, “they tend to keep up with inflation a little bit.”

I have read the document and it is overall well reasoned and well written. It seems pretty evident we have a competent staff providing excellent service. However, there is obvious cause for concern if one looks at Albany County and Laramie City budgets as a whole.

Albany County may be forced to cut the Sheriff's budget while Laramie continues to fund and invest at increased levels for the Laramie Police Department.

What the City should consider is disbanding the Laramie Police Department and contract Laramie City policing out to the Albany County Sheriff's Office. I am certain we can save money and increase efficiencies as well as LEO morale if we consider this option.

The budget documents obscure it somewhat, but it's clear on close examination that our city government is "middle-heavy;" we have an excess of overpaid middle managers. The reason our infrastructure has deteriorated (one of the top citizen concerns expressed during the recent election season) is that we're devoting too much money to cushy salaries for a large tier of middle managers and not enough to actually maintaining and fixing infrastructure. That's why the streets are not being fixed! Council should remedy this, but I am not hopeful that they will. Council seems to go along with whatever proposal is brought to them by those middle managers (who obviously won't cut their own ranks or opt for more reasonable salaries), even if it is not consistent with the public interest.