Recommended addition to city’s two-year budget goes big on construction

Public support for the 5th penny sales tax, the relatively new online sales tax, and COVID-era federal funding have contributed to a strong “stable” general fund, city officials tell the council.

Laramie will continue to fund large-scale construction projects into the next fiscal year — with the confidence that it’s now moved beyond the pandemic-era budget fluctuations that radically altered its revenue and expense columns in 2020 and 2021.

At least, that’s the hope of city staff, who presented a recommended supplemental budget to the Laramie City Council during a Wednesday work session.

The councilors approve a biennium budget every two years. But it’s impossible to know for certain how much revenue will come in from sales tax and other sources, or to anticipate every expense the city government will need or choose to make. So in the off years, such as this one, city staff produce a supplemental budget, recommending alterations for the final year of the biennium.

“This budget, like every year, but especially in the past three to four years, makes really significant investments into capital construction,” City Manager Janine Jordan told the council during a work session earlier this month. “Our community is growing and so we are continuing money and funding for large projects that you are familiar with, like the North Side Tank and Transmission Project and also the Wyoming Avenue Storm, Sewer, Water and Street Improvements.”

All told, city staff are asking for a $25.7 million supplemental appropriation, with another $80.2 million being re-budgeted from the previous year, for capital construction.

But there are two other high points Jordan noted during her address to council. First, the city is continuing to work on a compensation and staffing study. That study is likely to inform a request next year for staff raises.

“With the inflation we’ve seen and with that inflating wages, it’s really needed,” Jordan said. “And I suspect that it will come back and tell us our wages are a little bit lagging in the market … I’ll be surprised if it doesn’t say that. It may be, in part, why we’re having trouble recruiting. There’s a shortage of applications and workers, but if our salaries were a little more competitive, it would be more likely to entice people to take a risk on joining our team.”

Second, the only significant personnel changes in the recommended supplemental budget this year are for the Laramie Fire Department. LFD, which oversees EMS response in Laramie and beyond, is asking for a $700,000 increase to hire additional personnel. That includes funding for a civilian paramedicine program, as well as EMS “over-hires” — a redundancy that tries to get ahead of anticipated turnover.

“Of all of the changes that are being made in the realm of personnel in the second year of the biennium, they’re most notable in Chief (Dan) Johnson’s office,” Jordan said. “What you should know is there are no major changes to compensation and staffing yet suggested for fiscal 24 because we’re a little bit behind in getting our analysis done. So we expect we will be implementing those changes in the fall once we get that compensation study.”

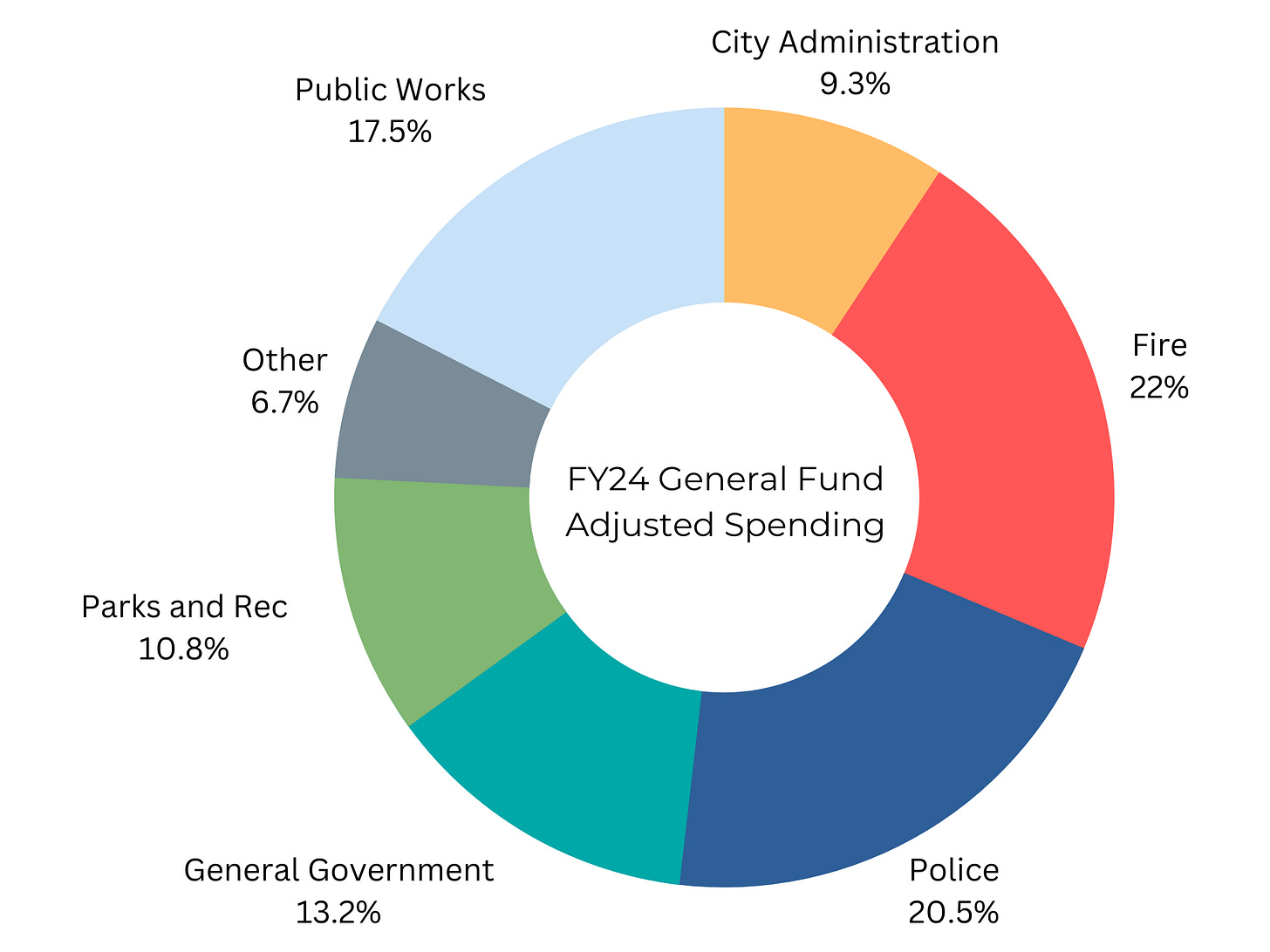

Jenn Wade, the city’s director of administrative services, talked to councilors about the state of Laramie’s general fund. The general fund is the city’s main pool of money — fed by sales and use taxes among other revenue sources, and providing for most government departments — from administration to parks to fire and police.

“I’m happy to report that the financial condition of the general fund is stable,” Wade said. “I would say, for a long time, the financial condition of the general fund was stable but barely getting by. And I would say it is stable and getting by with a lot of good planning these days, primarily because of some internally generated — as well as externally generated — revenue enhancements that have happened since fiscal year 2017.”

In 2017, Wade said the city instituted budget reductions to “align” operating expenses with city revenue. Since then, Laramie’s finances have improved.

“In the years that followed, there have been enhancements in revenue that have made that revenue base more favorable to funding government operations in the general fund,” Wade said. “In particular, continued voter support of the 5th penny optional tax has been critical to continue providing those services — without which we would actually have to dial back our services.”

Albany County voters re-approved the 5th penny tax during the 2022 general election. The tax funds about 20-25 percent of city services, but has to be reapproved every four years in a ballot initiative. An option to make that tax permanent — also appearing on the 2022 general election ballot — was rejected by voters.

The 5th penny is far from the only source of Laramie’s recent stability, however.

“Voter support for the sixth penny in 2018, to add a sixth penny that actually supported entirely governmental operations — so, think streets, parks and recreation, trails — that was really impactful to the general fund,” Wade said. “As well as Enrolled Act 23, passed in the 2019 General Session, that expanded the taxation of online sales. And so those things in combination have really made general fund revenue much healthier than it has been historically at the city of Laramie.”

The boost from online sales tax revenue was especially helpful during the early months of the pandemic, when in-person sales dried up.

“Thank goodness people were online shopping,” Wade said.

But the pandemic had a variety of effects on the city’s budget. The city manager instituted a spending freeze and eventually, the city started benefiting from federal pandemic assistance funding — such as the CARES Act. Add in a huge, one-time sales tax boost from wind energy development in 2021 and the city’s budget became difficult to forecast from one year to the next.

That volatility has settled down and Wade said fiscal year 2022 represented something of a return to normal.

A notable development in Laramie’s budgeting process is the way the city treats state dollars. Essentially, the state government can’t be trusted to provide any kind of reliable direct distribution — regular payments from the state to communities that have generally been decreasing for several years.

So the city has started to view direct distributions as something of a bonus, rather than a reliable source of government funding.

“In Laramie, for the past six or seven years, we actually have not considered the direct distribution an operating revenue source because we did not deem it reliable, based on, frankly, signaling from the state that we shouldn’t,” Wade said. “We still have structural balance without relying on the direct distribution. You’ll see that operating revenue still exceeds operating expenses by about $0.6 million, so that’s great news for the general fund’s financial condition.”

(The Wyoming Legislature actually set aside an additional $34 million for direct distributions this year — of which, Laramie will receive $2.5 million. Added to Laramie’s original distribution of $3.7 million, the Gem City will take home $6.2 million in direct distribution — well above what it budgeted for. The excess will be held in reserve and used to offset inflationary costs, according to the supplemental budget proposal.)

The council met again to hear more about the supplemental budget during a second work session May 17. That second meeting focused on some of the city’s enterprise funds — such as the water, wastewater and solid waste funds — which are supported by user fees and designed to be self-supporting.

Councilors are scheduled to vote on budget change motions during a special meeting May 27 and must approve the budget before the end of June, when fiscal year 2023 comes to a close and fiscal year 2024 begins.

The full recommended supplemental budget can be read online, as can the adopted FY23-24 biennium budget approved last year.